Thanks to the invention of direct deposit, many people never see their physical paycheck these days. And while it may be easier to have your paychecks directly deposited into your bank account than to deal with a paper check, you still need to check your paycheck stub regularly. Regularly reviewing your paycheck helps you catch inadvertent—or even purposeful—errors in your pay. Understanding your paycheck and all the notations that go along with it is critical to managing your money and protecting your income.

The first step in reading your paychecks involves becoming familiar with the standard financial and tax information that appears on them. Here’s what you need to know about how to read your paycheck.

How to Read a Paycheck Stub

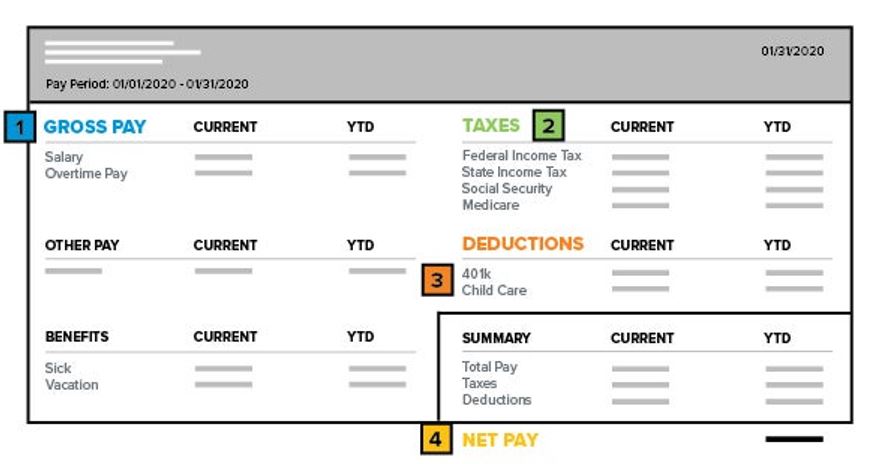

A pay stub generally includes the following information.

- Your gross pay, or the total amount of money that you earned that pay period.

- Withholdings for federal taxes, state taxes, health insurance premiums, Social Security and Medicare, which largely account for the difference between your taxable earnings and net pay.

- Other deductionsand benefits, such as child care payments, retirement contributions and paid time off.

- Your net pay, or the amount of money that you get to take home with you—this is the amount the paycheck is actually made out for

1. Gross Pay

Your gross pay is the total amount of money that you earned that pay period before taxes or any other deductions are taken out. This will include your hourly pay or salary, as well as any overtime pay or bonuses. If you earn $15 an hour and worked 30 hours, your gross pay will be $450.

This section will often include your gross pay for this paycheck, as well as your gross pay for the year to date (often marked as YTD).

2. Taxes

The taxes section is going to be one of the most confusing sections because there are so many different types of taxes to be accounted for. Your pay stub will generally indicate how much was taken out in that specific check as well as how much has been taken out so far that year.

Here are the basics you need to know about the tax deductions on your paystub.

Federal Income Taxes

The federal government gets a percentage of any income earned by its citizens. That’s what your income tax is. Your employer uses several pieces of information, including how much you make on average and how many dependents you said you have on your W-4, to estimate your federal tax liability. The estimated amount is divided by the number of pay periods you’ll have each year and that amount is deducted from your paycheck.

The money deducted for federal withholding tax is sent by your employer to the federal government. At the end of the year, if the amount withheld was more than your actual federal tax liability, you get a refund. If it was less than your actual federal tax liability, you owe taxes to the IRS.

You can change the amount that’s take out of each paycheck for federal withholding. It’s based in part on how many dependents you report on form W-4 to your employer. Reporting more dependents reduces how much is taken out of your check. Reporting fewer dependents increases how much is taken out.

State Taxes

Depending on where you live, you may or may not be required to pay a state income tax. As with federal taxes, money for state taxes is withheld from every paycheck. It shows up as a deduction on a separate line.

FICA

FICA stands for Federal Insurance Contributions Act. It’s the law that requires every person who works to contribute to Social Security and Medicare funds. If you see FICA on your paycheck stub, it is a deduction for these two federal programs. Some paycheck stubs break out the deductions and show you how you’re paying for both Medicare and Social Security.

- Every worker contributes 2% of their gross incomedirectly into the Social Security fund. Every employer chips in an additional 6.2%. The Social Security fund provides benefits to current Social Security recipients. If you’re self-employed, you must pay both the worker and employer portions of this tax. That means your paycheck is effectively reduced by 12.4%.

- The federal government also requires every working American to contribute to Medicare. Every worker contributes 1.45% of their gross income to Medicare, and every employer pays an additional 1.45% on behalf of each employee. Again, if you’re self-employed, you shoulder the entire burden and pay 2.9%.

3. Other Deductions

Unfortunately, we’re not done with the paycheck deductions yet. In addition to taxes, you’ll likely be paying for insurance accounts and other deductions.

Insurance

If you signed up for medical, dental or life insurance through your employer, you may see relevant deductions on your paycheck. Your employer might pay part of the premiums and require you to pay the rest. Your portion is taken out of your paycheck before taxes are calculated, which means you don’t pay taxes on these deductions.

Flexible Spending Accounts

A flexible spending plan allows you to set aside pre-tax dollars for medical expenses including health insurance copayments, deductibles and prescription drugs. Contributions to a flexible spending account are deducted from your pre-tax income.

Health Savings Accounts

A health savings account is another way to put pre-tax dollars aside in a special account for medical expenses. To be eligible for a health savings account, you’ll need to select a high-deductible health insurance plan. Contributions to a health savings account are deducted from your pre-tax income.

Retirement Savings Plans

Contributions to retirement savings plans such as a 401K or IRA plan are also deducted from your pay. When you sign up for a 401K plan, you select a percentage of your pre-tax salary that you’d like to contribute to your retirement account. Setting up retirement savings accounts lets you put money away for the future while saving on tax payments today.

4. Net Pay

Finally, we get to the real reason you were checking your paystub—the amount of money that actually ends up in your pocket. Your net pay is your gross pay minus all the deductions.

This lets you track how much money you’re making and how much money you’re actually taking home after taxes and other deductions throughout the year. You can use this information to build a spending plan, work on reducing your debts or start saving for the future.

Why It’s Important to Track Your Deductions

It’s important to stay on top of the information on your paycheck. Any errors are your responsibility to find and report to your company’s human resources department. The last you thing you want is for an error to be repeated through several pay periods and then have to pay for that mistake yourself. If your employer isn’t taking out enough taxes, for example, you can owe all that money at the end of the year.

Be sure to check that the information on your last pay stub of the year matches the information on your W-2 form. Your W-2 form details your wages and taxes paid for the year and is what you use to complete your income tax returns.

It’s also a good idea to spot check your pay regularly. If you get paid hourly, keep track of how many hours you worked. Check to ensure that you’re getting paid for all of the time you worked, as clerical errors can and do happen.

Check Your Paycheck Stubs Regularly

Whether you get a hard copy in an envelope at work or you have to log in to a secure payroll system, take a few minutes each pay cycle to peruse your check stub. If anything looks out of place, reach out to your employer for assistance. And while you’re looking at your paycheck stub, take a few moments to consider financial matters, such as budgeting or savings, to support financial stability for you and your family. You can even choose to have part of your check direct deposited into your savings account while the rest goes to checking.

This helpful article is from credit.com