by Hirsch Serman, MBA, CPA, CDFA

Do you need more time to file? No Problem!

The Federal deadline (as well as many state deadlines) to file your taxes is Tuesday, April 18, 2023.

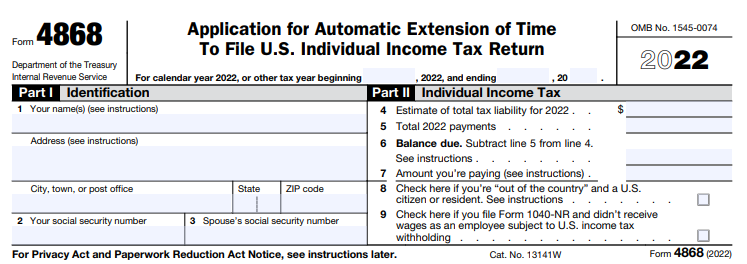

The good news is you can get more time. The not so good news is you still have to pay the estimated taxes owed. By filing an extension using IRS Form 4868, you will avoid any late filing penalties. The key is that you mail in the form or e-file the extension before the deadline passes. If mailing the extension, it is okay if the IRS receives it after the deadline, however, the return must have a post mark no later than May 17th.

The form itself is a relatively easy form to fill out. Follow these steps to fill out Form 4868 (if e-filing, your software will walk you through essentially the same steps):

- Click hereto fill out the form or to e-file, check the box in your information worksheet stating you want to electronically file the extension.

- Lines 1 through 3 is your personal info.

- Line 4 = estimated amount of taxes you owe.

- Line 5 = How much was paid through W2's, investment income, estimated payments, unemployment, retirement withdrawals etc.

- Line 6 = the difference (what is still owed).

- Line 7 = How much is being sent in with the extension.

This applies to most states as well. Here is a great article from TurboTax to see how your state handles extensions.

Happy filing!

Hirsch Serman, MBA, CPA, CDFA is the founder of Lifecycle Financial LLC, a company that helps those going through Divorce and other life cycle changes to navigate the financial pitfalls of a new life dynamic. The company was founded through personal experiences in divorce and watching the changes in an aging parent. He has worked in finance for over 20 years (including financial planning and tax) and has taught on the university level as well as conducted seminars for high school youth on personal finances. Hirsch is a member of the American Institute of CPAs, The Institute of Divorce Financial Analysts, The Amicable Divorce Network The National Association of Divorce Professionals, and the American Association of Daily Money Managers (AADMM).

Get to know Hirsch through his radio show The Financial Wellness Hour or reading his blogs and articles.

INC., US News & World, The Memphis Business Journal, Medium, Authority Magazine, DivorceMoms.com, and many other media outlets have all covered his work in Divorce and Hirsch was selected to be a New Orleans Entrepreneur Week Fellow. Hirsch has a passion to serve others and has worked with numerous non-profit boards including the United Way and is a trustee of Texas College. Please reach out with any comments to [email protected].